37+ veteran mortgage relief program 2021

Check with your servicer about the options available. Under this program the VA will make any overdue mortgage payments to the lender and then create a.

Steve Mclaughlin Sr Loan Officer Crosscountry Mortgage Llc Linkedin

Web Department of Veterans Affairs March 26 2021 Washington DC Loan Repayment Relief for Borrowers Affected by COVID-19 1.

. Web VA COVID-19 debt relief options for Veterans and dependents. In some cases Veterans can receive a 20 payment reduction in others the reduction can be even. Web Mortgage Relief Finance Programs for 2021.

Department of Veterans Affairs is offering two new mortgage relief programs to help those impacted by the pandemic stay in their homes. Jeffrey London Executive Director of the Veterans. By Amy Loftsgordon Attorney.

Thousands of mortgage borrowers with VA-guaranteed loans whove been affected by the coronavirus COVID-19 pandemic have received COVID-19 forbearances. We also offered a pause on collection for debts created before April 6 2020 as well as repayment plans. While the HARP program helped millions of homeowners after the housing crisis the program ended in 2018 and while Fannie.

Web If your mortgage is backed by FHA USDA or VA you may request up to two additional three-month extensions up to a maximum of 18 months of total forbearance. Web The US. Web VA will guarantee up to 50 percent of a home loan up to 45000.

So what are all these ads for a new homeowners stimulus that could provide more than 3700 to pay your. Web The claim. Web Veteran borrowers qualifying for the COVID-VAPCP must have been on a COVID forbearance occupy the property as a main residence and have been current or within 30 days of current on March 12020.

For loans between 45000 and 144000 the minimum guaranty amount is 22500 with a maximum guaranty of up to 40 percent of the loan up to 36000 subject to the amount of entitlement a veteran has available. Under this program the VA will make any overdue mortgage. Department of Veterans Affairs VA created a new program to help mortgage borrowers whose COVID-19 forbearances are ending.

Web Mortgage Relief Programs for Government-Backed VA FHA and USDA Loans. A mortgage refinance relief program works by replacing your existing loan with a newer loan with lower interest therefore resulting in more affordable payments. The VAPCP will only be available from July 27 2021 through October 28 2022.

Web The VA Partial Claim Payment Program is a temporary program that begins on July 27 2021 and runs through Oct. The Department of Veterans Affairs VA remains firmly committed to assisting VA-guaranteed loan borrowers who experience financial hardship due to the COVID-19 pandemic. Those with an FHA VA or USDA mortgage should look into some of the mortgage relief options mentioned in the list above.

Government-backed loans require the servicer to exhaust several options before resorting to foreclosure. Web WCMH Those 1200 pandemic stimulus checks have ended and are unlikely to return. Web The VA Partial Claim Payment Program is a temporary program that begins on July 27 2021 and runs through Oct.

Biden Congress created a generous mortgage relief program for veterans As home-sale prices continue to increase across the country posts claiming Congress established a. Web By Madison Czopek May 28 2021 No there is no Congressional program providing generous mortgage relief to veterans If Your Time is short There is no evidence that Congress established a. But to qualify you must have received your initial forbearance on or before June 30 2020.

Web WASHINGTON The Department of Veterans Affairs is offering a new COVID-19 Refund Modification option to assist Veterans who require a significant reduction in their monthly mortgage payments because of the COVID-19 pandemic. Web Mortgage relief is not automatic. Web Veteran mortgage relief options One benefit of a VA loanis that the Department of Veterans Affairs can help you if youre having trouble making mortgage payments.

Web This program will protect homeowners at risk of losing their homes thereby strengthening our communities and our economy and improving the lives of many Virginians across the Commonwealth. Eligible borrowers include those with VA-guaranteed or VA-held loans who are experiencing financial hardship caused by the Covid-19 pandemic. To help with financial relief during the COVID-19 pandemic we paused collection on all new VA benefit debt created between April 6 2020 and September 30 2021.

This loan relief or forbearance applies regardless of delinquency status according to the VA guidelines.

Va Expanding Covid 19 Mortgage Relief Options

Mortgage Relief Resource Center Veterans United Home Loans

The Wall Street Journal May 11 2021 Pdf Hedge Fund Bonds Finance

Mortgage Relief Resource Center Veterans United Home Loans

Amid A Pandemic Va Loans Are Quietly Having A Record Year

Mortgage Relief Resource Center Veterans United Home Loans

Seven Days June 30 2021 By Seven Days Issuu

Ulxselis4zvutm

Home Va Mortgage Relief

Housing Community Development

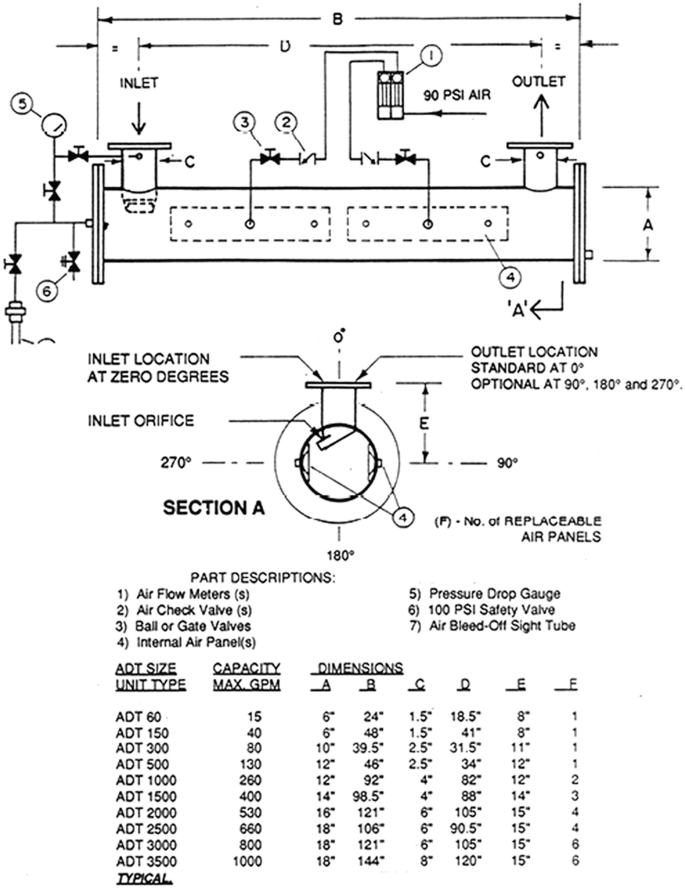

Humanitarian Engineering Education Of The Lenox Institute Of Water Technology And Its New Potable Water Flotation Processes Springerlink

Deborah Ogren Mankato Mn Real Estate Agent Realtor Com

Details Of The Cares Act Mortgage Relief Plan

Protections For Reverse Mortgage Borrowers Consumer Financial Protection Bureau

News Inside Veteran Benefits Veterans Benefits Administration

Mortgage Relief Resource Center Veterans United Home Loans

Veteran Homeowner Stimulus 40k Home Loan 2021